How to Trade Forex Position Trading

Introduction

Forex position trading is a long-term and patient trading strategy that involves holding positions for weeks, months, or even years to capitalize on significant price movements.

Section 1: Understanding Position Trading

1.1 What Is Forex Position Trading?

Forex position trading is a trading style that aims to profit from long-term trends and price movements in currency pairs.

1.2 Key Concepts

Long-Term Focus: Position traders have a long-term perspective and aim to ride substantial price trends, disregarding short-term fluctuations.

Fundamental Analysis: Fundamental analysis plays a significant role in position trading, as traders assess economic, political, and geopolitical factors that can influence currency values over time.

Section 2: Trading Strategies for Forex Position Trading

2.1 Identifying Position Trading Opportunities

Fundamental Analysis: Analyze economic indicators, interest rates, geopolitical events, and central bank policies to identify potential currency pairs for long-term positions.

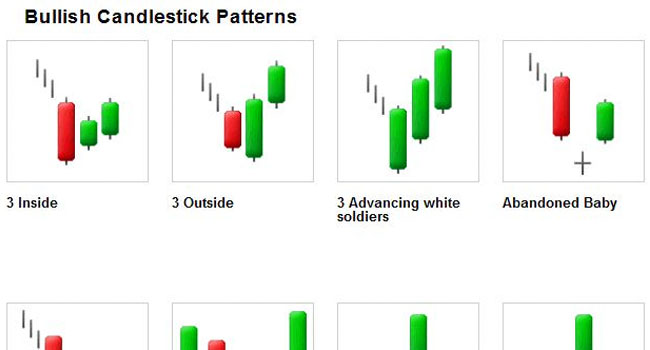

Technical Analysis: Use technical analysis to confirm entry and exit points, identify trend reversals, and manage risk.

2.2 Types of Position Trading Strategies

Trend Following: Position traders often align their positions with the prevailing long-term trend, holding positions as long as the trend remains intact.

Contrarian Positioning: Contrarian traders go against prevailing market sentiment, looking for opportunities when they believe prices have reached extreme levels and are due for a reversal.

2.3 Risk Management in Position Trading

Position Sizing: Position sizing is crucial for managing long-term exposure.

Stop Loss Orders: Implement wide stop loss orders to protect against significant adverse price movements while allowing positions room to breathe.

Section 3: Fundamental Analysis in Position Trading

3.1 Economic Indicators

Stay updated on economic indicators like GDP growth, employment figures, inflation rates, and trade balances, as these can impact currency values over time.

3.2 Interest Rates and Central Bank Policies

Monitor interest rates and central bank policies in different countries to gauge the direction of currency pairs and potential interest rate differentials.

Section 4: Real-World Examples and Case Studies

This section will provide real-world examples and case studies illustrating different position trading scenarios. These examples will offer practical insights into how traders apply position trading strategies in various market conditions.

Section 5: Challenges in Position Trading

5.1 Patience and Discipline

Position trading requires patience and discipline, as traders must endure periods of drawdown and resist the urge to make frequent adjustments.

5.2 Emotional Resilience

Develop emotional resilience to handle fluctuations in the open positions and maintain confidence in the long-term outlook.

Section 6: Risk Management and Capital Preservation

6.1 Diversification

Diversify your position trading portfolio by trading a mix of currency pairs and possibly other asset classes to spread risk.

6.2 Leverage and Margin

Be cautious with leverage and margin, as they can magnify losses in long-term positions. Use power sparingly and adhere to strict margin requirements.

Section 7: Position Trading Tools and Resources

7.1 Fundamental Analysis Tools

Utilize economic calendars, news feeds, and financial news websites to stay informed about economic events and fundamental factors that can impact your positions.

7.2 Long-Term Charts and Indicators

Use long-term charts and indicators, such as moving averages and trendlines, to analyze and confirm the long-term trends in your chosen currency pairs.

Section 8: Developing a Trading Plan for Position Trading

8.1 Goal Setting

Set realistic and achievable long-term trading goals, considering your risk tolerance and investment horizon.

8.2 Trade Entry and Exit Criteria

Establish straightforward entry and exit criteria for your position trades based on a combination of fundamental and technical analysis.

Section 9: Continuous Learning and Adaptation

9.1 Stay Informed

Stay updated with global events, market developments, and shifts in economic trends to adapt your position trading strategies accordingly.

9.2 Portfolio Management

Continually assess and adjust your position trading portfolio by adding or reducing positions based on changing market conditions and your evolving outlook.

Section 10: Trade Journaling and Performance Tracking

10.1 Detailed Trade Journal

Maintain a detailed trade journal to record your position trades, including the fundamental and technical factors influencing your decisions and your emotional state during your careers.

10.2 Performance Metrics

Track key performance metrics, such as overall portfolio performance, drawdowns, and returns, to evaluate the effectiveness of your position trading strategy.

Section 11: Practical Tips and Techniques for Position Trading

11.1. Position Monitoring: Regularly review your open positions and adjust your trading plan if fundamental or technical factors change significantly.

11.2. Long-Term Entry and Exit Rules: Set specific criteria for entering and exiting long-term positions and adhere to them faithfully to maintain discipline.

Section 12: In-Depth Fundamental Analysis

12.1. Geopolitical Events: Stay attuned to geopolitical events that could impact the currency pairs you are trading, as they can have long-lasting effects on exchange rates.

12.2. Interest Rate Differentials: Continually monitor interest rate differentials between currencies, as these can drive long-term trends and influence carry trade strategies.

Section 13: Advanced Position Trading Techniques

13.1. Carry Trade: Consider incorporating carry trade strategies, where you buy a currency with a high-interest rate and finance it by selling a coin with a lower interest rate.

13.2. Hedging: Explore hedging strategies to protect your long-term positions from adverse price movements, particularly during uncertain market conditions.

Section 14: Real-World Examples and Case Studies

This section will provide real-world examples and case studies illustrating different position trading scenarios. These examples will offer practical insights into how traders apply position trading strategies in various market conditions.

Section 15: Challenges in Position Trading and How to Overcome Them

15.1. Psychological Resilience: Develop psychological resilience to withstand extended periods of drawdown and uncertainty in long-term positions.

15.2. Market Monitoring: Stay vigilant and adaptable to changing market conditions, as long-term trends can experience reversals or accelerations.

Section 16: Risk Management Revisited

16.1. Portfolio Diversification: Diversify your position trading portfolio across multiple currency pairs to reduce the impact of adverse price movements in one team.

16.2. Contingency Plans: Have contingency plans to address unexpected events, such as sharp market movements, and decide how you will react.

Section 17: Position Trading Tools and Resources

17.1. News and Economic Calendars: Stay informed about scheduled economic events and releases that can affect your long-term positions.

Section 18: Developing a Trading Plan for Position Trading

18.1. Risk Management Rules: Establish comprehensive risk management rules that govern your position sizing, stop loss placement, and overall portfolio management.

18.2. Exit Strategies: Determine different exit strategies for your long-term positions, including trailing stops and profit-taking levels.

Section 19: Continuous Learning and Adaptation

19.1. Stay Educated: Continually educate yourself about the forex market, global economic trends, and evolving fundamental factors.

19.2. Networking: Connect with other position traders and seek insights and advice from experienced traders in the field.

Section 20: Trade Journaling and Performance Tracking

20.1. Position Trade Journal: Maintain a detailed position trade journal to document your analysis, trade rationale, and ongoing assessment of long-term positions.

20.2. Long-Term Performance Metrics: Track performance metrics relevant to your position trading strategy, including annualized returns, maximum drawdowns, and risk-adjusted metrics.

Section 21: Practical Tips and Techniques for Position Trading

21.1. News Monitoring: Stay updated with relevant news and economic events that could impact your long-term positions. Develop a routine for staying informed about global developments.

21.2. Scheduled Reviews: Schedule regular reviews of your open positions to ensure they align with your long-term outlook and fundamental analysis.

Section 22: In-Depth Fundamental Analysis

22.1. Political and Economic Stability: Assess the political and economic stability of countries whose currencies you are trading, as strength can influence long-term trends.

22.2. Global Economic Trends: Consider broader global economic trends, such as shifts in trade dynamics or technological advancements, that may affect currency pairs over time.

Section 23: Advanced Position Trading Techniques

23.1. Fundamental Analysis Models: To refine your trade decisions, explore advanced fundamental analysis models, such as the purchasing power parity (PPP) or interest rate parity models.

23.2. Diversification Strategies: Implement diversified position trading strategies that include a mix of major, minor, and exotic currency pairs to spread risk and capture diverse opportunities.

Conclusion

Forex position trading is a patient and long-term strategy that empowers traders to capitalize on significant price trends in the currency markets. By mastering the techniques, practising discipline and risk management, and continuously learning and adapting to market conditions, traders can navigate the forex market with confidence and competence.

Position trading offers traders substantial profit potential, but it comes with the challenges of endurance, patience, and the ability to withstand drawdowns. Whether new to trading or an experienced trader refining your approach, position trading offers a strategic alternative for those with a long-term outlook. With commitment and a deep understanding of position trading principles and techniques, you can elevate your trading proficiency and potentially achieve significant success in the dynamic world of forex markets.