Forex Trading: How to Use Technical Analysis in 2023

Forex trading, the dynamic world of currency markets, demands a nuanced understanding of market trends, price movements, and potential entry and exit points. In 2023, technical analysis remains a cornerstone of successful trading strategies.

Understanding Technical Analysis

1. Foundations of Technical Analysis:

The core idea is that historical price patterns tend to repeat, allowing traders to identify potential opportunities.

2. The Role of Charts:

Charts are the visual representation of price movements over time. Various charts, including lines, bars, and candlestick, are used in technical analysis. Candlestick charts, rich information about opening, closing, and high and low prices for a given period, are viral among Forex traders.

Key Technical Analysis Tools

1. Trend Lines:

Objective: Identify and confirm trends.

Approach: Draw trend lines to connect significant lows in an uptrend or highs in a downtrend. Trend lines help confirm the direction of the trend and can be used to anticipate potential trend reversals.

2. Support and Resistance Levels:

Objective: Identify levels where the price may bounce or reverse.

Approach: Support levels are where prices tend to stop falling, while resistance levels are where prices often pause or reverse. Identifying these levels helps traders make informed decisions about entry and exit points.

3. Moving Averages:

Objective: Smooth out price data to identify trends.

Approach: They are handy for identifying the direction of the movement and potential trend reversals.

4. Relative Strength Index (RSI):

Objective: Identify overbought or oversold conditions.

Approach: RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. A high RSI indicates potentially overbought conditions, suggesting a reversal might be imminent, while a low RSI signals potential oversold conditions.

Candlestick Patterns for Precision

1. Single Candlestick Patterns:

Objective: Interpret individual candlestick formations.

Approach: Single candlestick patterns, such as doji, hammer, and shooting star, convey important information about market sentiment and potential reversals. Understanding these patterns can enhance your decision-making process.

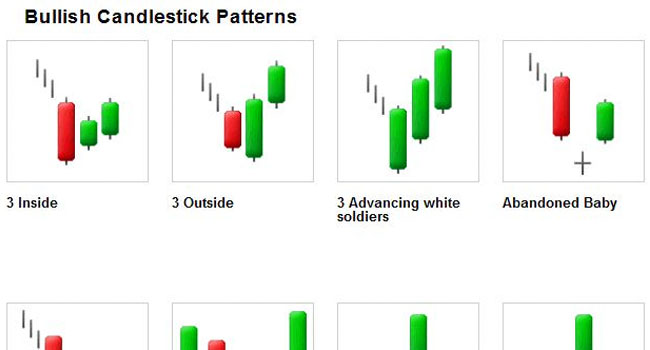

2. Multiple Candlestick Patterns:

Objective: Analyze sequences of candlestick formations.

Approach: Patterns like engulfing patterns, harami, and evening or morning stars involve multiple candlesticks. These patterns offer more comprehensive insights into potential trend reversals or continuations.

Advanced Technical Indicators

1. Fibonacci Retracements:

Objective: Identify potential reversal levels.

Approach: Fibonacci retracements identify potential levels of support or resistance based on the Fibonacci sequence. Traders use these levels to anticipate where a price retracement might end and the trend resume.

2. Bollinger Bands:

Objective: Gauge volatility and potential reversal points.

Approach: Bollinger Bands consist of a middle band being an N-period simple moving average and upper and lower bands being N-period standard deviations away from the middle band. These bands help identify volatility and potential reversal points.

Integrating Multiple Time Frames

1. Multitime Frame Analysis:

Objective: Gain a holistic view of the market.

Approach: Analyzing charts across multiple time frames, such as daily, hourly, and 15-minute charts, provides a more comprehensive understanding of the market. This approach helps identify trends and potential reversal points with greater accuracy.

2. Top-Down Analysis:

Objective: Start with a broader perspective and narrow it down.

Approach: Begin with a higher time frame, like the daily or weekly chart, to identify the overall trend. Then, move to lower time frames for more precise entry and exit points. This top-down analysis improves the accuracy of your trading decisions.

Approach: Program trading algorithms that incorporate technical analysis indicators and patterns. Automated strategies can execute trades based on predefined technical conditions, removing the emotional element from trading decisions.

2. Machine Learning in Technical Analysis:

Objective: Enhance predictive capabilities with machine learning.

Approach: Machine learning can adapt to changing market conditions and refine predictions.

Trading Psychology and Technical Analysis

1. Emotional Discipline:

Objective: Cultivate emotional control.

Approach: Emotional discipline is crucial in trading. Stick to your technical analysis and trading plan, even when faced with market fluctuations. Emotional discipline ensures that decisions are based on logic rather than impulsive reactions.

2. Mindfulness in Trading:

Objective: Stay present and focused during trades.

Approach: Mindfulness techniques like meditation or focused breathing exercises can help traders stay present and focused. Being mindful reduces the likelihood of succumbing to emotional biases during trading.

Tailoring Technical Analysis to Forex

1. Understanding Forex Market Dynamics:

Objective: Adapt technical analysis to the unique features of the Forex market.

Approach: Recognize that Forex markets operate 24 hours a day, five days a week. Consider the impact of global economic events and news releases on currency pairs. Additionally, factor in geopolitical events that might influence Forex prices.

2. Major and Minor Pairs Analysis:

Objective: Distinguish between major and minor currency pairs.

Approach: Major pairs involve currencies from major economies, while minor teams include coins from smaller economies. The liquidity and volatility of significant pairs may differ from those of minor pairs. Tailor your technical analysis to account for these distinctions, considering factors like liquidity and market dynamics specific to each couple.

Adaptive Technical Analysis for Forex Trading

1. Machine Learning Models for Currency Prediction:

Objective: Use machine learning for currency price prediction.

Approach: Develop machine learning models that analyze historical data and market variables to predict currency price movements.

2. Sentiment Analysis in Forex:

Objective: Incorporate sentiment analysis into technical analysis.

Approach: Monitor market sentiment by analyzing news, social media, and economic indicators. Sentiment analysis can provide insights into how traders perceive specific currency pairs, influencing market dynamics.

Harmonic Patterns and Wave Analysis

1. Harmonic Trading Patterns:

Objective: Identify precise reversal and continuation points.

Approach: Harmonic patterns, such as Gartley, Butterfly, and Bat patterns, involve specific Fibonacci ratios and geometric shapes. These patterns can provide precise entry and exit points, enhancing the accuracy of your trades.

2. Elliott Wave Theory:

Objective: Analyze wave patterns for trend identification.

Approach: Elliott Wave Theory suggests that markets move in repetitive wave patterns. Understanding these patterns can help identify trends and potential reversal points, adding a wave-based dimension to your technical analysis.

Real-Time Data Visualization Tools

1. Advanced Charting Software:

Objective: Utilize advanced charting tools for real-time analysis.

Approach: Invest in charting software with advanced features, including real-time data updates, multiple time frame analysis, and customizable indicators. These tools provide a dynamic and comprehensive view of market movements.

2. Algorithmic Pattern Recognition:

Objective: Implement algorithms for pattern recognition.

Approach: Use algorithmic tools that automatically identify and highlight chart patterns. This reduces the time spent manually scanning charts and promptly identifies potential opportunities.

Integrating Fundamental Analysis with Technical Analysis

1. Macro-Fundamental Indicators:

Objective: Combine technical analysis with critical economic indicators.

Approach: Consider how major economic indicators, such as GDP growth, interest rates, and employment data, align with your technical analysis. Integrating fundamental analysis provides a more holistic view of currency pairs.

2. News Event Impact Analysis:

Objective: Factor in the impact of news events on technical patterns.

Approach: Understand how scheduled economic releases and geopolitical events influence currency prices. Be aware of major news events and their potential to disrupt or reinforce technical patterns.

Ethical Considerations in Forex Trading

1. Responsible Trading Practices:

Objective: Trade ethically and responsibly.

Approach: Consider the ethical implications of your trading decisions. Avoid practices that could manipulate markets or exploit vulnerabilities. Responsible trading practices contribute to the integrity of the financial markets.

2. Social Impact of Forex Trading:

Objective: Assess the broader impact of Forex trading.

Approach: Recognize the social consequences of currency fluctuations, especially in emerging markets. Consider how your trading activities may impact local economies and communities.

Continuous Learning and Adapting Strategies

1. Stay Informed About Market Innovations:

Objective: Keep abreast of technological advancements in trading.

Approach: Regularly explore new tools, technologies, and methodologies in Forex trading. Staying informed about market innovations ensures that your technical analysis remains cutting-edge.

2. Engage with Trading Communities:

Objective: Exchange insights with fellow traders.

Approach: Join online forums, attend trading conferences, and engage with trading communities.

Advanced Risk Management within Technical Analysis

1. Incorporate Risk Metrics into Analysis:

Objective: Integrate risk metrics with technical analysis.

Approach: Include risk metrics in your technical analysis, such as the Sharpe ratio or maximum drawdown. This ensures that your trading decisions align with your risk tolerance and overall risk management strategy.

2. Dynamic Position Sizing Based on Volatility:

Objective: Adjust position sizes based on market volatility.

Approach: Incorporate volatility-based position sizing into your technical analysis. During heightened volatility, reduce position sizes to account for increased market risk.

Conclusion: Mastering the Art of Forex Trading with Technical Analysis

In 2023, mastering Forex trading requires a comprehensive understanding of technical analysis and adaptability to market dynamics. From traditional indicators to advanced tools, integrating technical analysis into your trading strategy provides a roadmap for navigating the complexities of currency markets.