Top Mistakes New Forex Traders Make

Forex trading is an exciting and potentially profitable activity, but it’s challenging. New traders are especially vulnerable to mistakes that can quickly become costly losses. In this article, we’ll discuss some of the most common mistakes new Forex traders make and how to avoid them.

Lack of education and preparation

The biggest mistake new Forex traders make is jumping into the market without adequate education and preparation. Forex trading is a complex and dynamic activity that requires much knowledge and skill to succeed. It’s essential to understand the basics of Forex trading, such as currency pairs, price movements, and technical analysis. Without proper education, traders are more likely to make irrational decisions that can lead to significant losses.

New traders should invest time in education and preparation to avoid this mistake—numerous online resources, such as educational courses, webinars, and forums. Practicing trading on a demo account before risking real money is also a good idea.

I do not have a trading plan.

Another common mistake new Forex traders make is needing a trading plan. A trading plan is a set of guidelines that helps traders make informed decisions based on their goals and risk tolerance. It should include entry and exit points, stop-loss levels, and risk management strategies.

Without a trading plan, traders are likelier to make impulsive decisions based on emotions like fear and greed. This can lead to significant losses and erode their trading account quickly.

New traders should create a trading plan before entering the market to avoid this mistake. The plan should be based on their individual goals and risk tolerance and should be reviewed regularly.

Overtrading

Overtrading is a common mistake among new Forex traders. Overtrading occurs when traders enter too many trades simultaneously, increasing risk and potential losses. New traders are often eager to make money quickly, leading them to trade frequently without proper analysis.

To avoid overtrading, new traders should focus on quality over quantity. They should only enter trades that meet their trading plan’s criteria and avoid impulsive decisions.

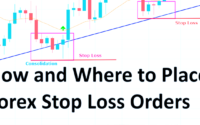

Failing to use stop-loss orders

Stop-loss orders are a crucial risk management tool in Forex trading. They allow traders to limit their losses by automatically closing a position when the price reaches a predetermined level. Failing to use stop-loss orders can lead to significant losses, as traders can be caught off guard by sudden price movements.

New traders should always use stop-loss orders when entering a trade to avoid this mistake. Stop-loss orders should be placed at a level that limits the potential loss while allowing for reasonable price fluctuations.

Chasing the market

Another common mistake new Forex traders make is chasing the market. Chasing the market occurs when traders enter a trade based on the fear of missing out on a potential profit. This can lead to impulsive decisions based on something other than proper analysis, leading to significant losses.

To avoid chasing the market, new traders should focus on their trading plan’s criteria and avoid making decisions based on emotions. They should also avoid entering trades outside their trading plan’s guidelines.

Trading without proper risk management

Risk management is a crucial component of Forex trading. Traders must understand and manage their risk exposure to limit potential losses. New traders must often implement proper risk management strategies, leading to significant losses.

New traders should implement risk management strategies such as position sizing, diversification, and stop-loss orders to avoid this mistake. They should also clearly understand their risk tolerance and only enter trades that fit their risk profile.

Ignoring market trends

Ignoring market trends is another common mistake new Forex traders make. Traders who need to recognize and follow market trends are likelier to enter unprofitable trades. This can lead to significant losses and missed opportunities.

To avoid this mistake, new traders should analyze market trends and use technical analysis tools to identify patterns and trends. They should also stay up-to-date with news and events that can impact the market and adjust their trading plan accordingly.

Lack of patience

Patience is a virtue in Forex trading. New traders often need more patience and try to make quick profits, leading to impulsive decisions and significant losses. Forex trading requires discipline and the ability to wait for the right opportunities to enter and exit trades.

New traders should focus on their trading plan and avoid making impulsive decisions to avoid this mistake. They should also have realistic expectations and understand that profits may take time.

Over-reliance on indicators

Indicators are useful for Forex traders, but they should rely on more than exclusively. New traders often need to pay more attention to indicators and consider other factors that can impact the market.

New traders should use indicators to avoid this mistake and consider other factors such as news, events, and market sentiment. They should also use only a few indicators, which can lead to conflicting signals and confusion.

Failure to adapt to changing market conditions

The Forex market constantly evolves, and traders must adapt to changing market conditions. New traders often need to recognize changes in the market and continue to trade based on outdated strategies and analyses.

New traders should stay up-to-date with market news and events to avoid this mistake and adjust their trading plans accordingly. They should also be flexible and willing to adapt to changing market conditions.

It’s also important for new Forex traders to manage their emotions while trading. Emotions such as fear, greed, and excitement can cloud judgment and lead to impulsive decisions. Traders should develop the discipline to follow their trading plan and avoid making decisions based on emotions.

Additionally, new traders should understand that losses are a part of trading and not get discouraged by them. They should learn from their mistakes and use them to improve their trading strategies.

It’s also important for new Forex traders to choose a reputable broker and platform. They should research and compare different brokers before considering fees, customer support, and regulatory compliance.

Lastly, new traders should start with a small trading account and gradually increase their trading capital as they gain experience and confidence. They should not risk more than they can afford to lose and should only trade with funds they can afford to lose.

Another common mistake that new Forex traders make is overtrading. Overtrading refers to making too many trades, usually with small amounts of money, hoping to make quick profits. This approach can lead to significant losses as the trader is more likely to make mistakes and be exposed to higher transaction costs.

To avoid overtrading, new traders should focus on quality over quantity and only trade when clear opportunities fit their trading plan. They should also refrain from making multiple trades simultaneously, as this can lead to confusion and mistakes.

New traders should also be aware of the impact of leverage on their trades. Leverage allows traders to control larger positions with smaller amounts of capital and amplifies the risk of losses. New traders should be cautious with leverage and only use it after thorough education and understanding of the associated risks.

Lastly, new Forex traders should not rely solely on the advice of others. While seeking advice and learning from experienced traders is important, developing one’s trading skills and strategies is equally important. New traders should take responsibility for their trades and decisions and not blindly follow the advice of others.

Conclusion: New Forex traders can avoid common mistakes by focusing on quality over quantity, being cautious with leverage, taking responsibility for their trades, and not relying solely on the advice of others. By avoiding these mistakes and implementing sound trading strategies and risk management techniques, new traders can increase their chances of success in the Forex market.