How to Trade Forex with News Trading in 2023

News trading is a popular approach in Forex trading that involves capitalizing on the volatility and market reactions triggered by economic news releases, geopolitical events, and central bank announcements. By staying updated with relevant news and understanding the potential impact on currency markets, traders can seize trading opportunities and make informed decisions. This article will explore how to trade Forex with news trading in 2023 effectively.

Understanding News Trading

News trading is based on the principle that significant news events can generate substantial market movements, creating profit opportunities. Traders specializing in news trading monitor economic calendars, news releases, and geopolitical developments to anticipate market reactions. By acting swiftly and strategically, traders aim to profit from short-term price fluctuations caused by news events.

Step 1: Stay Updated with Economic Calendars

Start by staying updated with economic calendars, which provide schedules of critical financial indicators, central bank meetings, and other news releases. These calendars highlight vital events that impact currency markets. Monitor relevant news events’ release dates and times to prepare for potential trading opportunities.

Step 2: Identify High-Impact News Events

Not all news events have the same impact on currency markets. Focus on high-impact events that typically create significant market volatility. Economic indicators such as GDP reports, interest rate decisions, employment data, and inflation figures often generate substantial market reactions. Additionally, monitor central bank statements, geopolitical events, and trade-related announcements that can influence currency values.

Step 3: Analyze Market Expectations

Market expectations play a crucial role in news trading. Analyze market sentiment, forecasts, and consensus expectations leading to news events. This information helps you gauge how market participants anticipate the news outcome. By understanding market expectations, you can position yourself to capitalize on potential deviations from consensus forecasts, which often lead to increased market volatility and trading opportunities.

Step 4: Plan Your Trading Strategy

Before the news release, develop a clear trading strategy. Consider employing conditional orders such as limit or stop orders to execute trades once specific price levels are automatically reached. Establishing a well-defined trading plan ensures you act swiftly and decisively when news breaks.

Step 5: Implement Risk Management Techniques

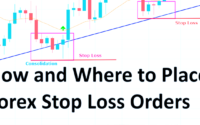

News trading involves heightened volatility, which can amplify risk. Implement effective risk management techniques to protect your capital. Set appropriate stop-loss orders to limit potential losses if the market moves against your trade. Consider adjusting your position size based on the expected impact of the news event. Be cautious of slippage and widening spreads during volatile periods and adapt your risk management accordingly.

Step 6: Utilize Fast and Reliable News Sources

Access fast and reliable news sources to receive real-time updates and analysis. Utilize news terminals, financial news websites, and reputable news agencies that provide accurate and timely information. It is essential to receive news releases and market analyses as soon as possible to capitalize on news trading opportunities.

Step 7: Act Swiftly and Responsibly

When trading news events, timing is critical. Act swiftly when the news breaks and the market reacts. Execute your trades based on your predefined strategy and entry points. However, exercise caution and trade responsibly. Avoid impulsive trading decisions driven by emotions or knee-jerk reactions. Stick to your trading plan and be mindful of the risks involved.

Step 8: Monitor Market Reaction and Adjust

Once the news is released, monitor the market reaction closely. Observe the initial price movements and the subsequent market behavior. Assess the extent of the market’s response to the news and whether it aligns with your expectations. Pay attention to critical technical levels, support and resistance zones, and chart patterns that may influence price action. Based on your analysis, consider adjusting your stop-loss levels, trailing stops, or profit targets to manage your trades effectively.

Step 9: Stay Calm During High Volatility

News events can result in heightened market volatility, leading to rapid price fluctuations. It is crucial to stay calm and composed during these periods. Emotions such as fear or greed can cloud judgment and lead to irrational trading decisions. Stick to your trading plan, maintain discipline, and avoid overtrading or chasing the market. Remember that preserving capital and managing risk should always be a priority.

Step 10: Learn from News Trading Experience

News trading requires continuous learning and refinement of skills. Reflect on your past news trading experiences and evaluate your performance. Analyze your trades, including both profitable and losing ones. Identify patterns, strengths, and weaknesses in your trading approach. Consider keeping a trading journal to record your observations and lessons learned. You can enhance your decision-making process and achieve better results by continuously improving your news trading strategies.

Step 11: Diversify Your News Sources

Expand your sources of news and analysis to gain a broader perspective. While relying on reliable and reputable sources is essential, considering multiple viewpoints can help you develop a more comprehensive understanding of market dynamics. Engage with financial news websites, expert blogs, forums, and social media platforms where traders and analysts share insights. Diversifying sources can provide alternative viewpoints and help you make more informed trading decisions.

Step 12: Understand the Context

When trading news, it is crucial to understand the broader context and underlying factors influencing the market. Consider the interplay between economic indicators, central bank policies, geopolitical events, and market sentiment. Assess how news releases fit into the financial narrative and the potential long-term implications. By having a holistic view, you can make more informed trading decisions and avoid being swayed by short-term market noise.

Step 13: Use a Demo Account for Practice

If you are new to news trading or want to test new strategies, consider using a demo trading account. Practice trading news events without risking real money to gain experience, try different approaches, and fine-tune your trading strategy. Use the demo account to familiarize yourself with the speed of news releases and their impact on currency markets.

Step 14: Keep Learning and Stay Updated

News trading requires continuous learning and staying updated with global economic and political developments. Stay informed about major news events, economic releases, and geopolitical situations that can impact currency markets. Follow central bank announcements, speeches by key policymakers, and relevant financial data releases. Attend webinars, workshops, or seminars to gain insights from experienced traders and industry experts. The more knowledgeable and informed you are, the better equipped you will be to trade news effectively.

Step 15: Focus on High-Impact Currency Pairs

When news trading, it is advisable to focus on high-impact currency pairs. These pairs exhibit higher liquidity and volatility during news events, making them ideal for news trading strategies. By specializing in a few currency pairs, you can better understand their behavior and improve your ability to anticipate market reactions.

Step 16: Understand Market Reaction Patterns

Observe and analyze market reaction patterns to news events over time. Certain news releases may consistently lead to specific price movements or trends. For example, positive employment data may result in a rally in a currency, while weak economic indicators may lead to a decline. Understanding these patterns allows you to anticipate potential market reactions and adjust your trading strategy accordingly.

Step 17: Utilize Order Types for Effective Execution

When trading news events, consider utilizing specific order types for effective execution. Limit orders enable you to set a particular entry or exit price, ensuring that you enter or exit the market at a desired level. Stop orders can automatically trigger a trade if the price reaches a predefined level. Choose the appropriate order type based on your trading strategy and risk management preferences.

Step 18: Be Mindful of Slippage and Volatility

During news events, slippage and increased volatility can occur. It can happen when the market rushes, leading to execution at a different price than anticipated. Be aware of this possibility and consider using order types that help minimize slippage, such as limit or stop-limit orders. Adjust your position size and risk management strategies to account for potential volatility.

Step 19: Practice Patience and Selectivity

While news trading can be exciting, it is important to practice patience and selectivity. Not all news events will result in favorable trading opportunities. Exercise caution and wait for high-impact news events that align with your trading strategy. Avoid trading during periods of low liquidity or when the market is highly unpredictable. By being selective, you can focus on higher-probability trades and increase your chances of success.

Conclusion: news trading in Forex can be a rewarding but challenging strategy. You can capitalize on short-term price movements triggered by news events by staying updated with economic calendars, analyzing market expectations, and executing well-defined trading strategies. Implement effective risk management techniques, trade responsibly, and continuously learn from your experiences. With practice, discipline, and a thorough understanding of the market context, you can navigate the world of news trading in 2023 and potentially succeed in Forex trading.